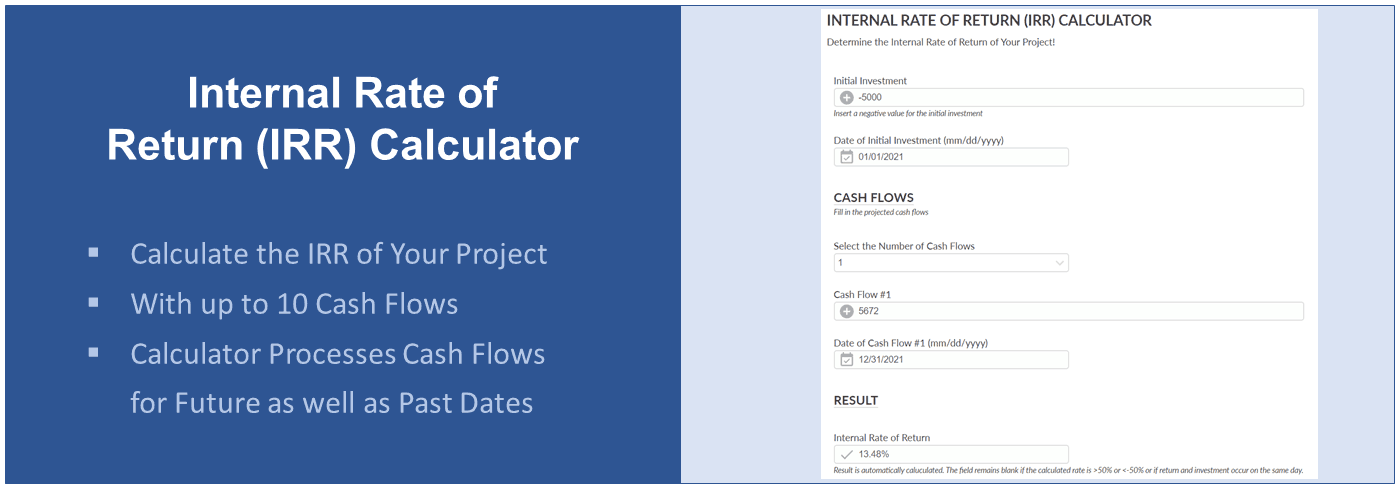

Real estate expense can be quite a extremely profitable opportunity, but maximizing returns involves careful analysis and proper decision-making. Among the most truly effective ways to examine the potential of home investment is by utilizing an Inner Rate of Return (IRR) calculator. That tool assists investors measure the profitability of home by calculating the rate at which the investment's web present value (NPV) means zero. With the proper method, an irr calculator online may be instrumental in ensuring that you make knowledgeable expense possibilities and obtain optimal returns.

Understanding IRR in True House Expense

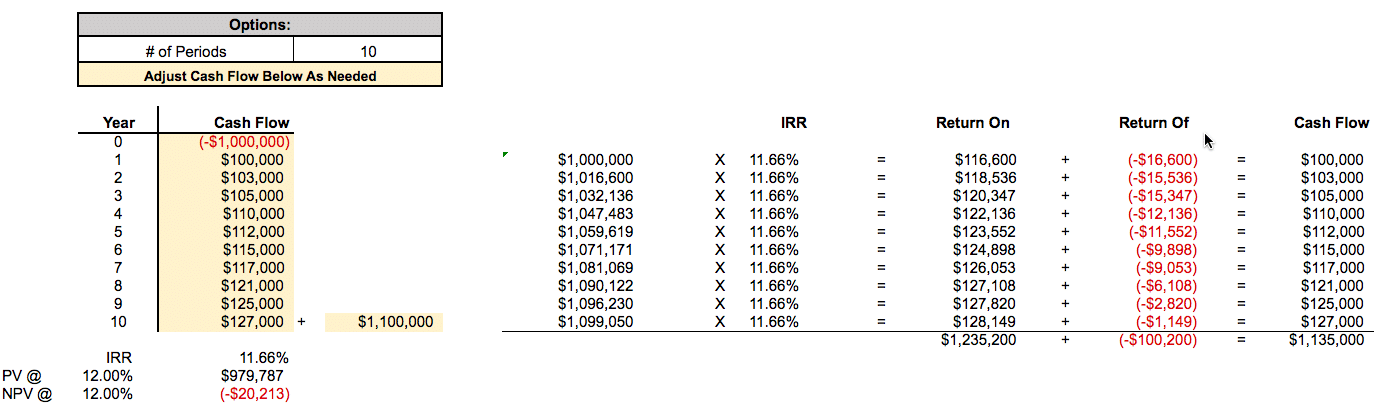

In real-estate, IRR describes the annualized charge of return on an expense over time, factoring in both the first capital outlay and the estimated potential cash flows from the home, such as rental income or resale profits. IRR essentially informs you the interest rate where your expense can separate even. If the IRR is larger compared to the required charge of return or the expense of capital, the expense is recognized as profitable.

For real-estate investors, IRR is a important metric because it records for the time value of money—recognizing that money nowadays may be worth more than the same amount in the future. By adding all inflows and outflows, including purchase price, financing expenses, continuing costs, and estimated revenue, IRR gives a thorough see of the investment's potential.

How an IRR True Estate Calculator Increases Expense Conclusions

An IRR property calculator simplifies this process by automating complicated calculations. Here's how it boosts your property investment's return:

Fast and Precise Calculations: An IRR calculator reduces the requirement for handbook calculations, letting investors to quickly determine the potential return on an investment with a few inputs. That effectiveness can save your self time and reduce the chance of human error.

Contrast of Numerous Houses: Investors frequently have to decide on between a few expense opportunities. Having an IRR calculator, it is possible to evaluate the estimated returns of numerous homes alongside, helping you identify probably the most lucrative option.

Long-Term Preparing: Real estate is frequently a long-term commitment. By factoring in predicted cash flows around many years, an IRR calculator helps you produce decisions that align together with your economic targets, ensuring your investment can stay profitable in the long run.

Conclusion

Maximizing the get back on a property investment requires a clear comprehension of its potential profitability, and an IRR real estate calculator is an important tool in this process. By giving a detailed, correct evaluation of estimated earnings and allowing evaluations between various investment opportunities, that tool ensures that you will be making data-driven decisions. If you are a veteran investor or new to the real property market, leveraging the power of IRR formula may somewhat boost your capacity to create knowledgeable, profitable investments.